Wyckoff Analytics – Basic Charting Course

Types of Charts: Vertical (aka Bar), Candlestick, Point & Figure (P&F), Candlevolume

- Descriptions and visual explanations of each type, including appropriate usage contexts and benefits

- Vertical bar (+ volume bars) – Tape Reading

- Point-and-Figure – companion to vertical charts, horizontal counts, less price volatility (not time), tape reading, volume

- Candlestick – Basic structure + visualizations

- Candlevolume charts – Combining candlestick + volume

Time Frames: intraday, daily, weekly, monthly

- Traditional timeframes and how they are best used. Campaigns (weekly + monthly), swing (daily), intraday (intraday + daily)

- Combining multiple timeframes

- Price and volume patterns are fractal on different time frames

The Market as a Discounting Mechanism and a visual representation of campaigns actions conducted by the Composite Operator (CO)

- Technical Analysis reveals the Discounting Mechanism. Definition. Long-term trend initiation, with catalyst(s) appearing later on.

- The Composite Operator as a heuristic for institutional participation

Cyclicality vs the Price Cycle

- Technical Analysis Cyclicality. 3-5 year business cycle

- Business cycle corresponds with the market cycle

- Wyckoff Price Cycle: Accumulation, Mark-up, Distribution, Mark-down

Trends and trading ranges within Price Cycle

- Price Cycle sequence: Accumulation, Mark-up, Re-accumulation, Mark-up, Distribution, Mark-down, Re-distribution

- Cyclicality of Price inside the channel

- Different time frames’ cyclicality and the Price Cycle

Trading Range: Support/Resistance, Breakouts, Failed Breakouts, Upthrusts (UT) and Springs/Shakeouts(SO) or Signs of Strength (SOS)/Signs of Weakness(SOW)

- Technical Analysis: Trading ranges explained

- Technical Analysis: Support and resistance defined

- Technical Analysis: Breakouts and failed breakouts

- Wyckoff: Support and resistance defined

- Wyckoff: UT and Spring/SO as failed breakouts + SOS/SOW as successful breakouts

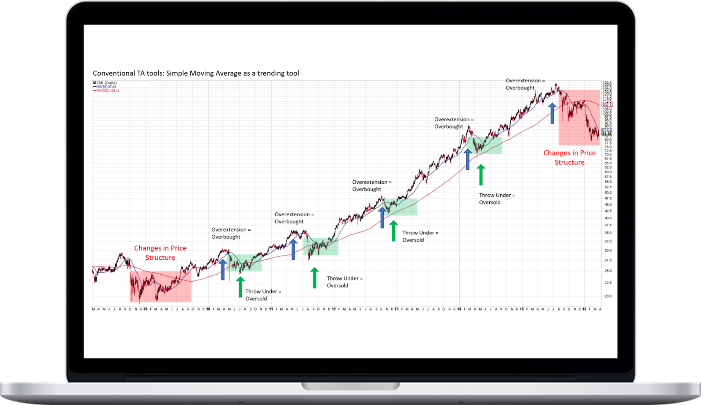

Trends: Definition – Higher Highs(HH)/Higher Lows (HL). Logarithmic vs arithmetic scales. Moving averages (MA), Linear Regression Line (LRL)

- Technical Analysis: Trend Definition. HH/HL for uptrends and the reverse for downtrends

- Comparison of logarithmic vs arithmetic scaling

- Technical Analysis: Trend defined by TA tools (MA, Linear Regression Line)

- Wyckoff: Also HH/HL

Trends: Conventional and Reverse Trendlines. Break of trendlines/Change of Character (ChoCh)

- Throw-overs and Oversold/Overbought conditions

- Break of Trendline signal. TA vs Wyckoff CHoCH

- Visuals: Multiple examples

Price formations: Technical Analysis Patterns

- Reversal vs continuation patterns

- Trading ranges, including triangles, flags and pennants, wedges

- Triangles of different kinds compared with Wyckoff’s Hinge or Apex

- Head & Shoulders, inverse patterns, double tops and bottoms,

- Parabolic, V-formations or spikes

- Rounding top/bottom formations

Wyckoff Price Formations: Accumulation

- Accumulation Events: Selling climaxes, secondary tests, springs, and others

- Accumulation Phases. Predictable sequences of Accumulation events

Wyckoff Price Formations: Distribution

- Distribution Events. Buying climaxes, secondary tests, UTs, and others

- Distribution Phases. Predictable sequences of Distribution events

Basic Technical Analysis definitions

- Volume leads price.

- Volume confirmation of price, with examples. Volume as evidence of Demand or Supply (or both).

- Volume divergence from price (non-confirmation), with examples.

Wyckoff Laws: Supply and Demand

- Wyckoff’s Law of Supply and Demand drives the Price Cycle. Example: Exhaustion of Supply in a trading range leads to an uptrend.

- Case study: Price Cycle resulting from changes in Supply and Demand

Wyckoff Laws: Effort vs. Result

- Effort vs. Results law. Definition.

- Result in line with Effort

- Non-confirmation. Result not in line with Effort.

Wyckoff Comparative analysis

- Original Wyckoff Course comparative visuals

- Basic construction and interpretation

- Significant highs and lows + slope

- Issues with comparative analysis

Relative Strength (RS) analysis

- Definition and basic construction

- Basic interpretation

- Heat Map ranking based on changes in RS

Technical Analysis Indicators useful to Wyckoff Traders. Rate of Change (ROC), Relative Strength Index, Stochastics, and On Balance Volume (OBV)

- Volume: OBV

- Momentum: ROC

Basic Technical Analysis P&F concepts (vertical measurements)

- One of the oldest charting methods

- P&F breakout patterns

- Vertical price objectives

Wyckoff P&F Basics (horizontal counts)

- Wyckoff’s Law of Cause and Effect

- Basic horizontal counting guidelines to determine price targets

- 1-box (swing) vs 3-box reversal (campaign)

- Intraday P&F counts examples